In the first two weeks since Sky Mavis, the team behind Axie Infinity (AXS) launched Katana, $1.8 billion in net assets moved from Ethereum (ETH) to Ronin (RON), a recent report reports . by DappRadar revealed.

The data collection and analysis company that tracks thousands of dApps across multiple blockchains says that in this short period of time, the first decentralized exchange (DEX) that runs entirely on Ronin has reached $1.3 billion. in the total keyed value (TVL).

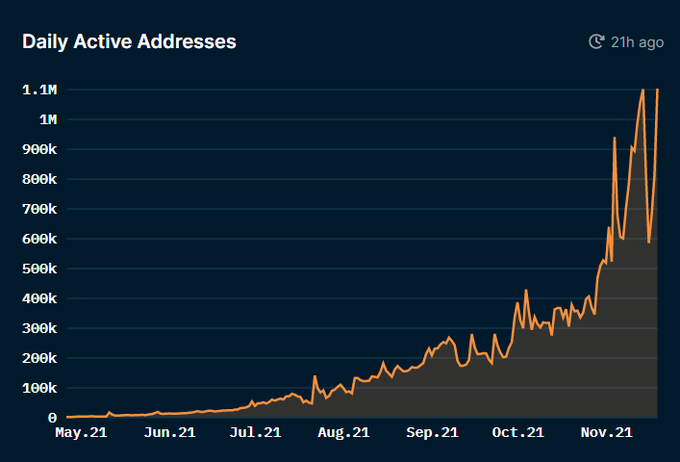

Meanwhile, the daily active address count for Ronin, the Ethereum-linked sidechain created specifically for Axie Infinity, has hit a new high, exceeding 1.1 million.

Farming RON

Axie is known as the spearhead of the Play-to-Earn (P2E) movement and, according to DappRadar data, attracts more than 2 million daily active players.

The release of Katana has increased the liquidity of all assets in the ecosystem, as it now allows users to swap between four tokens, with three liquidity pools, two of which allow users to farm tokens. origin and governance of Ronin, RON.

While the Ronin bridge has been fully operational since May, the launch of Katana has freed up the flow of value.

Over the past 30-day period, the Ronin bridge has recorded over $7.5 billion in volume and has emerged as the most used solution for moving assets out of Ethereum, bypassing the Avalanche bridges. and Polygon, among others.

During this time frame, AXS and ETH represent over 57% of all assets transferred from Ethereum.

“Ronin has shown the crypto industry how interoperability can be successfully accomplished, and the impact of skyrocketing Ethereum gas fees on a popular category like gaming highlights the importance of this.” , Modesta Masoit, Chief Financial Officer at DappRadar, commented.

Meanwhile, Ronin has reached a new milestone, surpassing 1.1 million daily active addresses, journalist Colin Wu reported.

Source: Twitter

Net Flow of ETH, AXS and SLP

Since the launch of Katana, Ronin has received over 182,600 ETH, equivalent to approximately $836.38 million.

“Of the ETH transferred to Ronin, 73% are locked in the Katana liquidity pools, providing the dApp with over $615 million in ETH liquidity,” the report added, noting that prior to the launch of Katana, the case was The main use of ETH in Ronin is to buy Axie's NFT.

The report revealed a similar story with AXS net flow. Within two weeks of Katana's launch, 7.74 million AXS, worth approximately $1.1 billion, were transferred to Ronin.

DappRadar notes that $363.7 million worth of AXS is locked in Katana for RON farming, representing almost 33% of total net AXS flows recorded since Ronin's launch.

For the game's main currency, Smooth Love Potion (SLP), which can be earned by completing adventure quests or winning PvP battles, Ronin recorded a net loss of 78.44 million dollars, when about 887 million SLP moved to Ethereum.

Players use SLP to cash out Axie Infinity’s P2E rewards, by converting those tokens on centralized exchanges (CEX) and “negative net SLP flow,” the report further explains that the SLP price 90% increase since Katana deployed.

From November 3 to November 6, the supply of AXS in Sushiswap fell by 82%, “reducing AXS liquidity from $5.5 million to just $320,000.” DappRadar also revealed that Katana has drained AXS liquidity from the Ethereum DEX.

“Maximalists may complain about security, but everyday users are clamoring for gas fees. And while it is not necessary that players connecting assets to Ronin trust the network, it is certain that allegiance to Ethereum will fluctuate in favor,” concluded Masoit.

✩ Viết tiếng Việt có dấu

✩ Không spam

✩ Không chửi tục, nói bậy

✩ Không quảng cáo thông qua khung Comment.

✩ Nhận giúp đỡ qua teamviewer